There is a surprising amount price variation on the auction closing price for the same piece of good on ebay. Certainly most of the time this includes consideration for the reputation of the sellers and other such miscellany, but even when the same seller sells, over time, multiple pieces of the same good, at the same time of the day every day, the price fluctuates by a least a few dollars each way around the mean, and occasionally by five dollars or more.

I am surprised that this happens. The distribution of closing prices should be sharply cut off at the lower end, because any good selling at substantially below the mean is subject to arbitrage on the price distribution. This works best for abstract goods like gift certificates, where there is no shipping cost to complicate matters. For example, a gift certificate sells for $100 on average, so you bid on all auctions for it at $95. If there is enough price fluctuation, you will get a few at that price. Now you relist them. There are more sophisticated options but let’s say you just relist them as auctions. Then on average, you will get $100. So you make $5 for each one sold.

If everybody thinks this can be done, they will all go do this and there will be no auctions that close below $95.

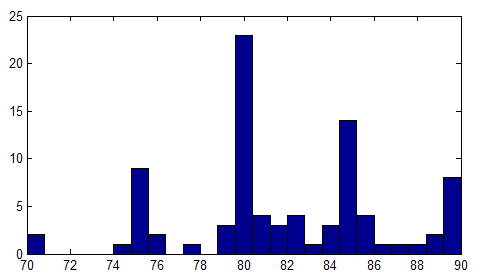

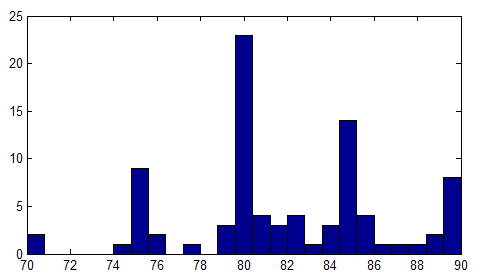

This shows closing prices of equally valued amazon gift certificates sold on ebay within the last two days. There are a lot of “buy it now” transactions listed, and those tend to be at the higher end. It seems like an excellent arbitrage opportunity right here to bid on auctions selling at below $80 and relist as “buy it now” for, say, $88. Ebay and paypal fees will eat about $6, so there is still a profit of at least $2 each time this happens.

This shows closing prices of equally valued amazon gift certificates sold on ebay within the last two days. There are a lot of “buy it now” transactions listed, and those tend to be at the higher end. It seems like an excellent arbitrage opportunity right here to bid on auctions selling at below $80 and relist as “buy it now” for, say, $88. Ebay and paypal fees will eat about $6, so there is still a profit of at least $2 each time this happens.

Comments(2)

Comments(2) This shows closing prices of equally valued amazon gift certificates sold on ebay within the last two days. There are a lot of “buy it now” transactions listed, and those tend to be at the higher end. It seems like an excellent arbitrage opportunity right here to bid on auctions selling at below $80 and relist as “buy it now” for, say, $88. Ebay and paypal fees will eat about $6, so there is still a profit of at least $2 each time this happens.

This shows closing prices of equally valued amazon gift certificates sold on ebay within the last two days. There are a lot of “buy it now” transactions listed, and those tend to be at the higher end. It seems like an excellent arbitrage opportunity right here to bid on auctions selling at below $80 and relist as “buy it now” for, say, $88. Ebay and paypal fees will eat about $6, so there is still a profit of at least $2 each time this happens.